13 Jun The Future of Veterinary and Pet Healthcare: Learning from Human Healthcare Innovations

By Arif Damji and Veda Patel

This is the first in a series on innovation across industries from the Conductive Ventures team. As generalist investors, we see innovation and development in many different industries. We believe that the lessons learned in one industry can help founders and investors identify trends and opportunities in another. In this blog series we will go through examples we have encountered from our experience. In this first part we discuss the similarities in innovations between human healthcare and pet healthcare.

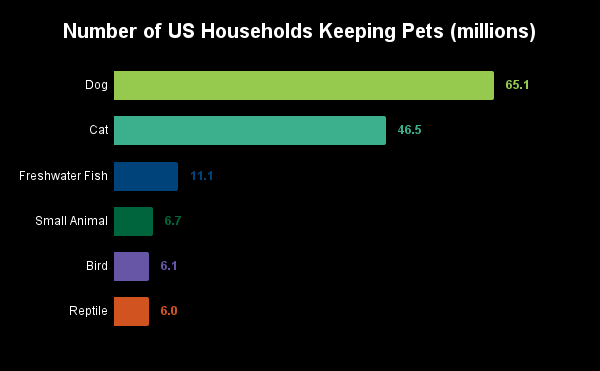

If you or someone you know adopted a pet during the COVID pandemic, you are not alone. The last decade has seen a boom in pet ownership. Over 80 million dogs are now cherished as family members in a two thirds of US households. This was up from 56% in 1988. This trend has been spurred on by the COVID work from home mandates and a transition to more flexible working arrangements. But that is not the only reason. More couples are choosing to postpone or forego having children completely and adopt a furry friend instead. The rise of this group of people among millennials and Gen Z in particular, has led to the evolution of the term DINK (Dual Income No Kids) to DINKWAD (Dual Income No Kids With a Dog) to describe them. And there has been a natural increase in spending on pet healthcare as a result. Most owners spend $50 to $250 per month on their furry companions, and some even spend upwards of $5,000! As a result, the global pet market is already estimated to have grown to over $320B today, with the potential to reach $500B by 2030.

Source: American Pet Products Association’s 2023-2024 National Pet Owners Survey

Despite this explosion in growth, pet healthcare still lags far behind human healthcare when it comes to innovations in many areas, including: therapeutics, medical devices, AI, electronic health records (EHR), and insurance. The good news is, however, the increasing demand for advanced veterinary care presents an opportunity for the industry to catch up, and even surpass, human healthcare in some of these areas. By applying the lessons learned from human healthcare, the veterinary industry is poised for a revolution that will ultimately benefit both pets and their owners. Here are some of the areas we see opportunities in.

Faster Innovation in New Drugs, Therapeutics, and Medical Devices

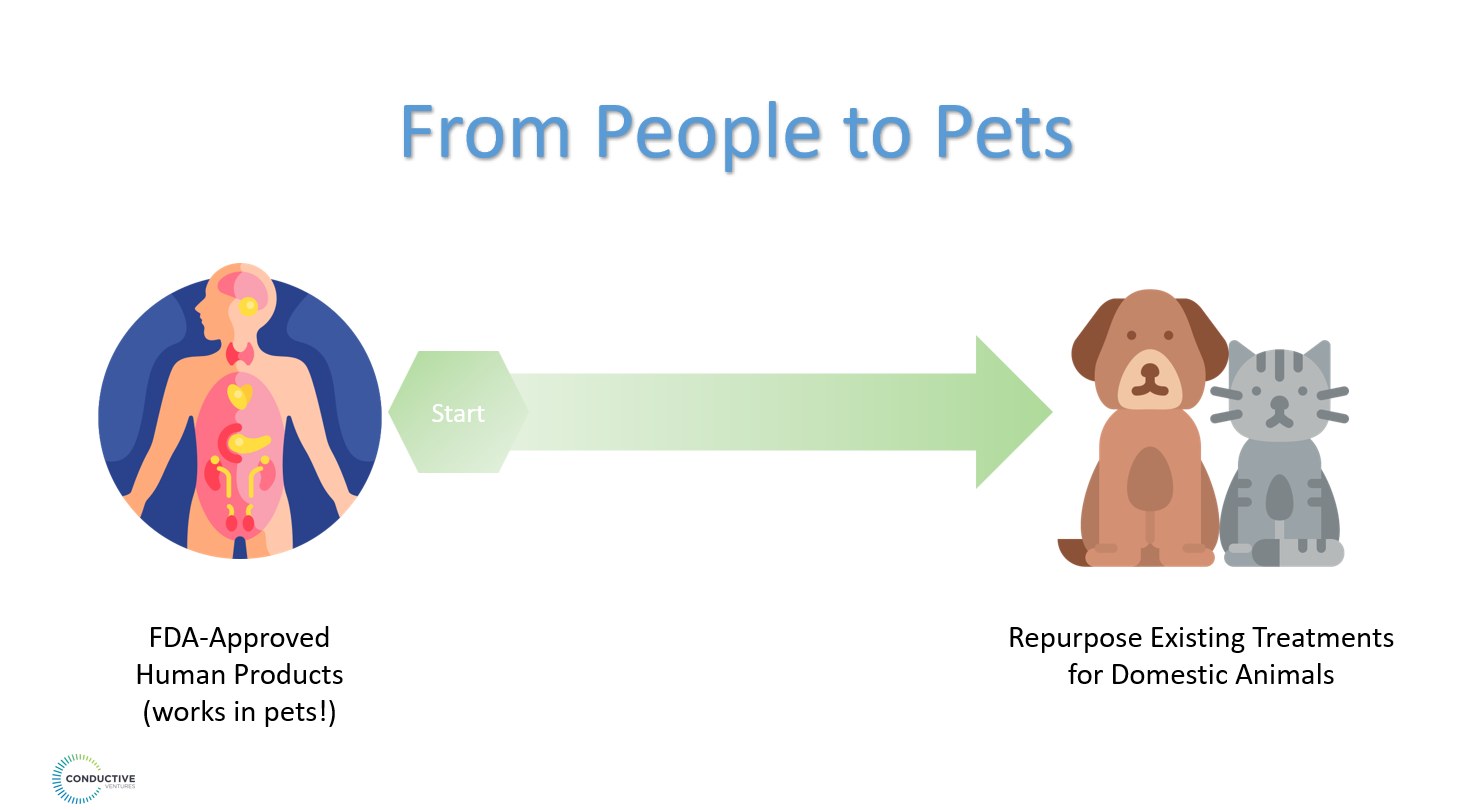

The drug approval process for human use is a lengthy and expensive journey. There is an average spend of $375 million in clinical trials but only 10% of drugs get approval. Most of our pets may have four legs, but you’ll be surprised that the physiological similarities between humans and animals mean that drugs sidelined for human use could be repositioned for pet health, where tolerability of side effects may differ, and regulatory barriers are less prohibitive. This presents an opportunity to recoup investments and further monetize these pharmaceuticals.

An interesting case is Pimobendan, a heart medication, which was initially placed in clinical trials for human use in 1988, but failed to improve mortality rates in patients with congestive heart failure. The drug was subsequently found to be effective in managing heart conditions in dogs and is now approved for veterinary use under the brand name Vetmedin.

With pet drug trials costing substantially less than human trials, and the approval process also being much shorter, pharmaceutical companies may conduct research and study therapies that have failed to receive FDA approval for human use and monetize them through animals. Merck Animal Health, Zoetis, and Elanco Animal Health are all examples of companies that have proven the value in therapeutic research for animals.

Similarly, medical devices developed for human use can often be adapted for pets. Wearable activity trackers like Fi smart collars, FitBark, and Tractive, continuous glucose monitoring systems like the FreeStyle Libre system by Abbott and Dexcom’s G6, and remote patient monitoring devices are just a few examples of technologies that have been successfully applied to pet health.

There are even innovative applications in animal health that better human health. For example, through rapidly designing and testing preventative treatments in animals, Resilient Biotics is optimizing formulations beneficial to immune responses, which can eventually be applied to treat humans. Christopher Belnap, founder of Resilient, tells us: “Building a new therapy in large mammalian species, like pigs, which are known to be more similar to humans in terms of anatomy and immunity is beneficial for understanding how we can translate the same approach to human health.”

Applying AI to address vet care shortages

In HealthTech, we see the criticality of AI across almost every specialty, from dermatology to cardiology, in increasing the accuracy and speed of analysis and diagnosis. It also aids in reducing the burden of specialist shortages seen across the country. For example, there are only 31,960 specialists in radiology but the demand for these services is increasing as a result of advancements in medical imaging and an aging population. In fact, in a study presented in 2021, it is reported that the number of radiologist trainees increased only 2.5% while the population over 65 grew by 35% showing a major discrepancy. Startups like Aidoc are bringing in human-in-the-loop AI based solutions to improve accuracy and aid in diagnosis. As a result, turnaround time can be reduced by up to 41%.

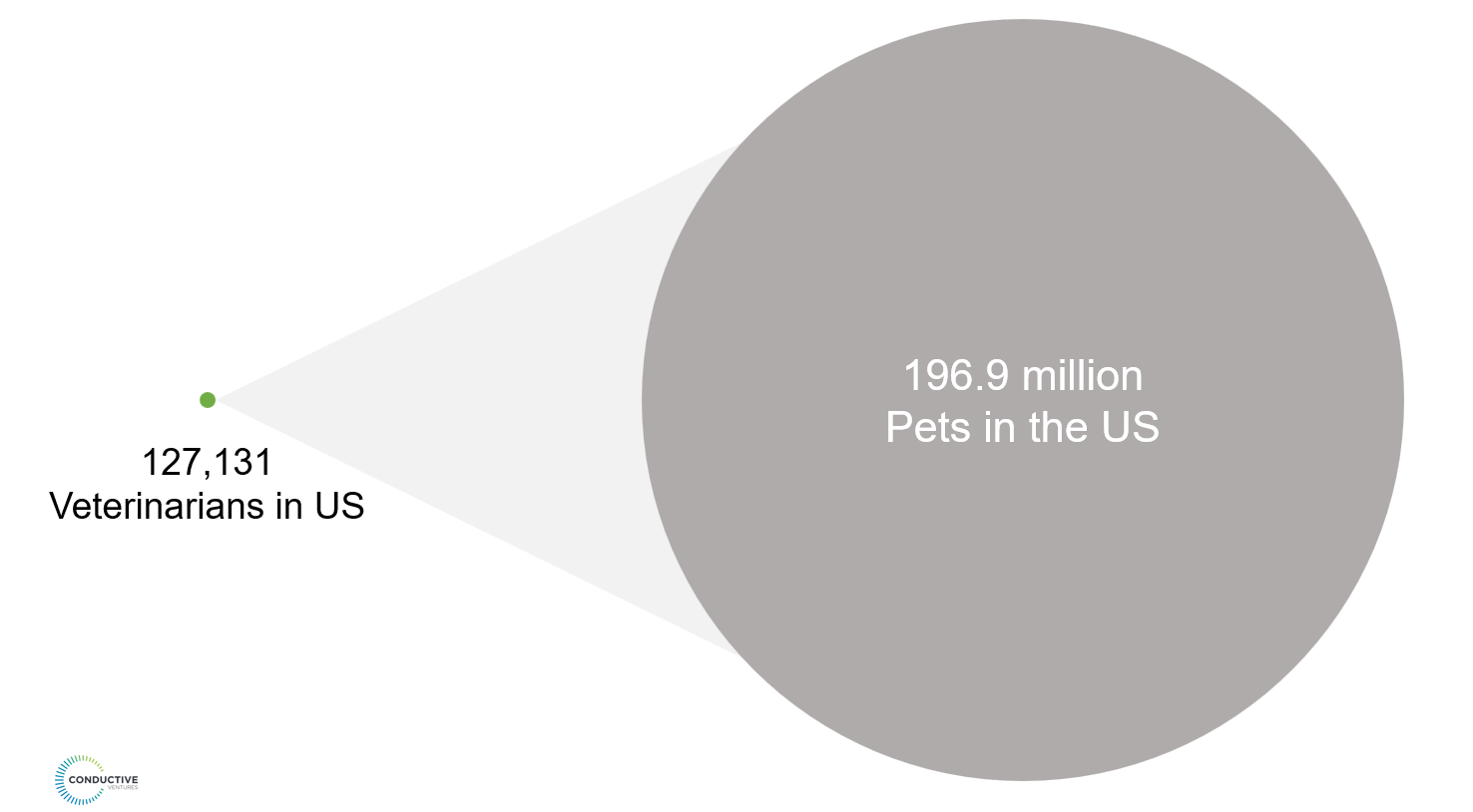

Similarly, escalating demand for veterinarians driven by surging pet ownership is creating a significant shortage expected to reach 40,000 vets by 2030, along with 133,000 vet techs. This leads to extended wait times and emergency clinics turning away non-critical cases. This shortage exists for a few reasons:

- Veterinarians are grappling with burnout, pressure from quotas, accreditation demands, and outdated technology.

- Veterinarians are feeling financial strain: The average veterinary school debt stands at a staggering $188,853, with a median of $99,000, adding stress to an already challenging work environment.

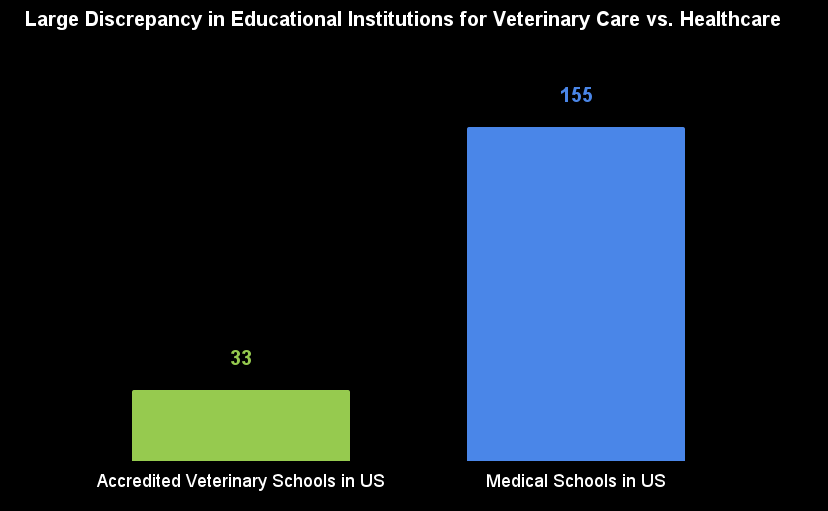

- We can’t train veterinarians fast enough: There are only 33 accredited veterinary schools in the US. It would take over 30 years for veterinary technician graduates to meet the industry’s 10-year demand.

- The pet-to-vet ratio is worsening: The rise in pet ownership by nearly 30% during the pandemic is contrasted with only a 10% increase in practicing veterinarians.

Source: Veterinary Practice News

Just as AI advancements have helped to automate and streamline many processes in human healthcare and reduce labor demand, it is starting to play a crucial role in enabling vets to focus on more complex cases. AI-powered tools can assist in various aspects of veterinary care, such as:

- Triage: AI algorithms analyze pet owners’ initial descriptions of their pets’ symptoms and prioritize cases based on urgency, directing critical cases to veterinarians while providing guidance for less severe issues.

- Diagnostic support: AI processes vast amounts of data from medical records, imaging, and test results to suggest potential diagnoses and treatment options, helping veterinarians make more accurate and timely decisions.

- Remote monitoring: AI-powered wearables and remote monitoring devices collect and analyze pet health data, alerting veterinarians to potential issues and enabling proactive care.

By leveraging AI technologies, veterinary practices can optimize their workflows, reduce wait times, and provide more affordable and accessible care to a larger number of pets. This not only benefits pet owners, but also helps alleviate the burden on veterinarians, allowing them to focus on the most critical cases and improve overall patient outcomes.

Source: American Veteran Medical Association, Ibis World

Companies like Moichor are already utilizing AI to increase the effectiveness and efficiency of animal lab work, with a 57% increase in disease detection and 10x less variability. As Shevy Karbasi, the founder of Moichor has said in an interview: “AI is not meant to replace veterinarians but to empower them. By automating routine tasks and providing data-driven insights, AI can help veterinarians work more efficiently and effectively, ultimately improving the quality of care for pets.”

As more data is collected, we see a future where AI applications in vet tech could expand to imaging, predictive analytics for disease prevention, and even behavioral analysis and training.

Digitizing Pet Insurance

Human health insurance is already rather complex, and we have seen innovations such as prior authorization, AI forward claims processing and chatbots, predictive analysis, and more, change the landscape of the product offerings. Health insurance differs from all other forms, such as property and casualty (P&C), fire, life etc. and has unique methods of billing, claims and data interoperability. This is a result of a simple fact: coverage of evolving health conditions in a human being is vastly different from covering stagnant values. In fact insurance providers are often unique with their own actuarial base and models, ensuring a theoretically smoother process for patients.

Did you know that when it comes to insurance, our pets have traditionally been viewed as property for insurance purposes, falling under P&C coverage rather than health coverage? But P&C coverage is notoriously difficult to claim, expensive and has very limited coverage with some only offering emergency coverage. It also doesn’t account for evolving health conditions, similar to human health insurance. It can take months to be reimbursed and many question whether it even makes sense. In fact only 3% of US pet owners have pet insurance, according to Odie, an embedded pet insurance provider.

Source: pumpkin.care

A slew of startups are trying to address this gap. Companies like Lemonade, Pumpkin, Pawp, and Bivvy have digitized the pet insurance process, enabling better policy management through mobile apps, direct billing, and personalization. As Todd Haedrich, with experience in vet tech through Covetrus and human health innovations through Optimize Health and Oxehealth, has told us: “The digitalization of the veterinary industry has been a gradual process that has recently gathered momentum in the last decade. Without an equivalent HITECH Act, innovation and adoption of animal health EMRs have taken much longer. Similarly, pet insurance has only recently accelerated, with the first plans introduced in the 80’s and electronic claim submission just starting over the past 20 years.“

These innovations are not only making insurance for our furry friends more accessible and user-friendly, but in some cases even more efficient than traditional human health insurance:

- Simplified underwriting: Pet insurance providers are using advanced data analytics and machine learning to streamline the underwriting process. By analyzing factors such as breed, age, and medical history, they can quickly assess risk and offer personalized coverage options, reducing the time and complexity involved in obtaining insurance.

- Direct billing and reimbursement: Companies like Nibbles are introducing credit card products bundled with pet insurance, allowing pet owners to charge all medical expenses to a single card. Claims are automatically filed and paid before the bill is due, reducing out-of-pocket expenses and simplifying the reimbursement process. This direct billing approach is more efficient than the complex billing and reimbursement systems often found in human health insurance.

- Preventive care incentives: Pet insurance providers are increasingly offering coverage for preventive care, such as annual check-ups, vaccinations, and dental cleanings. By encouraging pet owners to invest in preventive care, insurers can help reduce the likelihood of more serious and expensive health issues down the line. This proactive approach to healthcare is often lacking in human health insurance plans, which tend to focus more on reactive care. Odie is an example as they reimburse for more day-to-day services, such as pet daycares, dog walking, and others that promote pet health.

- Flexible coverage options: Pet insurance providers are offering a wider range of coverage options, allowing pet owners to customize their plans based on their specific needs and budget. This flexibility is in contrast to the more rigid, one-size-fits-all approach often seen in human health insurance plans. Miles Thorson, CEO of Odie agrees, as he said to The Digital PawPrint: “We’re going to see more in-network versus out-of-network structures and pre-negotiated levels of care.”

A bright future for pets and their “hoomans”

The rise of pet ownership, increased spending on pet health, and the unique opportunities present in the pet health space have created a favorable environment for advancements in numerous areas. We think there is potential to not only catch up to human healthtech, but lead the way in certain areas, potentially influencing the broader healthcare community and leading to improved patient outcomes, increased efficiency, and better quality of care for all.

As we have seen above, pet healthtech companies have the potential to develop novel solutions that could benefit both pets and humans alike. As Timmy Yu from Proper Pet states: “We always talk about pet-tech catching up with health-tech, but that is stage one. The next stage is a world where Pet may lead, driven by lower regulatory barriers, agile innovation processes, and eager pet parents wanting to try everything for their pets.”

While there is still much to be explored and developed, the potential for pet healthtech to play a significant role in shaping the future of healthcare is noteworthy.

Source: istockphoto

References

APPA. (2023). APPA Strategic Insights for the Pet Industry: Pet Owners 2023 and Beyond.

Congressional Budget Office. (2021). Research and Development in the Pharmaceutical Industry.

Nature Reviews Drug Discovery. (2016). Parsing Clinical Success Rates.

U.S. Bureau of Labor Statistics. (2023). Occupational and Employment Wages, May 2023.

Radiology Society of North America. (2022). Radiology Facing a Global Shortage.